Private labels conquer consumers’ hearts, minds and wallets

In 2023, European shoppers bought more private label items than in 2022. This increase in number of items sold is a remarkable difference with 2022. That year, private label only gained volume share because its volume decline was less than falling sales of branded products. In 2022, both branded and own label couldn’t match the 2021 sales levels, which peaked as a result of Covid-19. But in 2023, consumers massively switched to private labels, as many worried about high inflation rates.

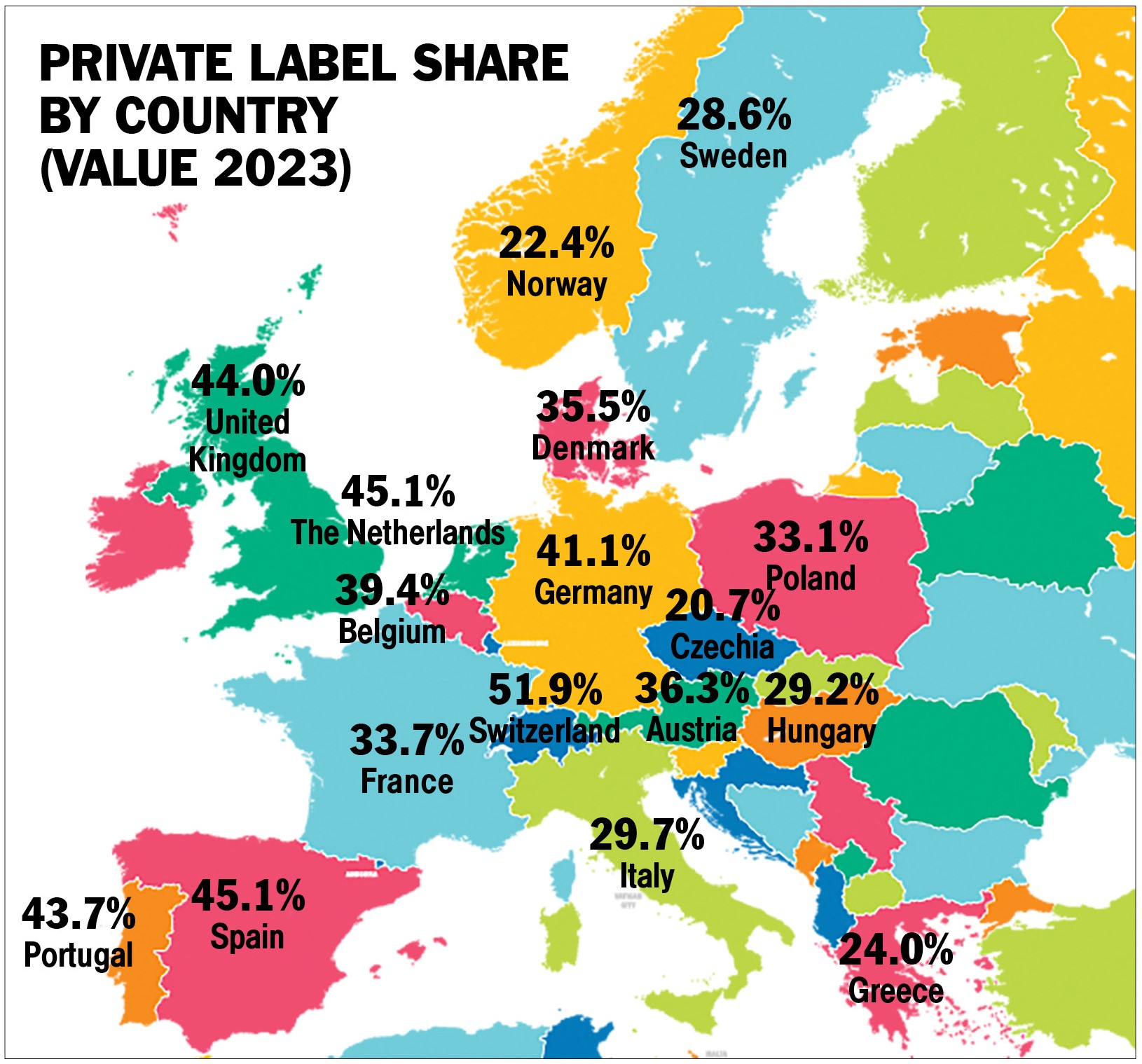

This and much more can be seen in the new edition of PLMA’s International Private Label Yearbook, for which NielsenIQ surveyed 17 European markets. Overall, retailers sold 2% more private label items in 2023, with Portugal (+9%), Czechia (+8%), Poland (+6%) and Spain (+5%) scoring well above average. Shoppers in the Netherlands and in Belgium (both -1%) and in Hungary (-8%) however, bought less private label items.

Overall, sales of private label items have been resilient. Reduced volume sales in 2022 compared to the record year of 2021, turned in 2023 into a 2% growth of private label items sold in Europe’s retail channels. By contrast, total volume sales – including branded items as well – was still declining in 2023. In 11 of the 17 countries surveyed, retail shoppers bought less items, leading to an overall volume reduction of -1%.

In 2023 the European grocery market value grew by 9% to €883 bn. With €39 bn more value sales, private label accounts for 54% of this €72 bn increase. In 2023 private label accounts for 38.5% of the European grocery market, with sales of €340 bn in the 17 countries surveyed.

From a value perspective the Yearbook clearly shows the impact of inflation. Turnover of all items – brands and private label increased despite the -1% in unit volume sales in the 17 European countries. Increasing costs for ingredients, material, energy and other inputs were to some extent factored into consumer price levels, hence the inflation.

Excluding branded, this inflationary effect is also visible. The 2% volume increase only partially accounts for the 13% value growth of private label in the 17 countries. In Hungary – where volume sales on item level of private label declined by -8% – the turnover of private label still increased by 12%. Here baby diapers is the leading private label category. In Portugal where shoppers bought 9% more private label items, turnover increased by 23%. Cheese is the main category for private label, not only in Portugal but 10 out of the 17 markets surveyed.

Overall cheese is Europe’s category with most private label growth, followed by bread, sweet biscuits, yoghurt and frozen potato products who respectively complete the European top 5. Especially in times of inflation, more consumers appreciate the quality and price value of private labels.

Switzerland remains the country with highest private label shares, but it seems as if it has reached the ceiling in the alpine country. Growth percentages are significantly lower compared to other European countries. Switzerland is the only country with a single-digit value share growth (4%) while turnover of private label in all other countries surveyed increased by at least 10%.

Two years ago Czechia had the lowest private label shares, but in recent years it has grown its sales volume significantly and to such an extent that the Central European market bypassed Norway, which now has the lowest volume share. Also in Czechia cheese is the category with strong growth of private label sales.

Like Norway, also in Sweden private label share is relatively low despite the fact that in both Nordic countries private label is growing. In Norway frozen fish leads the growth, in Sweden its frozen meat. The further south in Europe, the larger the appetite for private label. In Spain and Portugal private label is already dominant both in volume and value, but in 2023 the growth continued.

Falling sales levels after 2021, when Europe’s grocery sales peaked as a result of covid-19, have been met in 2023 by recovering sales of private labels. In an inflationary environment, Europe’s consumers massively embrace private labels, appreciating their price and quality.

Private label products encompass all merchandise sold under a retailer's brand. That brand can be the retailer's own name or a name created exclusively by that retailer. In some cases, a retailer may belong to a wholesale group that owns the brands that are available to only the members of the group.

Major supermarkets, hypermarkets, drug stores and discounters offer products under the retailer's brand. Private label covers lines of fresh, canned, frozen, and dry foods; snacks, ethnic specialties, pet foods, health and beauty, over-the-counter drugs, cosmetics, household and laundry products, DIY, lawn and garden, paints, hardware, auto care.

For the consumer, private label represents the choice and opportunity to regularly purchase quality food and non-food products at savings compared to manufacturer brands, without waiting for promotional pricing.

Private label items consist of the same or better ingredients than the manufacturer brands, and because the retailer's name or symbol is on the package, the consumer is assured that the product meets the retailer's quality standards and specifications.

Manufacturers of private label products fall into three classifications:

• Large manufacturers who produce both their own brands and private label products.

• Small and medium size manufacturers that specialise in product lines and concentrate on producing private label almost exclusively.

• Major retailers and wholesalers that operate their own manufacturing plants and provide private label products for their stores.